Author: Luke Hasskamp

Any time a dominant market player takes aggressive steps in the face of competition, that can catch people’s eye, especially those attuned to antitrust issues. That reality is true for the PGA Tour and its response to reports of efforts to launch a competitor golf league—the Premier Golf League.

For professional golfers and their fans, a pretty significant story broke this week about an upstart golf league seeking to get off the ground. The long-rumored Premier Golf League, or PGL, resurfaced, with the promise of upending professional golf across the globe. The PGL looks to attract some stars of the game with substantial, guaranteed contracts worth tens of millions of dollars, and massive payouts for each event, with a reported season-long payout total of one billion dollars.

Updates

1. Is Antitrust Litigation the Next Stop in the PGA Tour’s Battle with the Upstart LIV Golf League?

2. Is the PGA’s Suspension of 17 Players Out of Bounds Under the Federal Antitrust Laws?

In response to news about the PGL, the PGA Tour has taken several steps. The Tour started by introducing a so-called “Player Impact Fund,” which would award $40 million in annual bonuses to the top 10 players considered to drive fan and sponsor engagement, even if they’re not consistently winning. Unlike most earnings on Tour, these bonus payments would not be directly tied to a player’s performance during tournaments. This response seems like a legitimate and pro-competitive way to respond to market competition.

Perhaps more interestingly, the PGA Tour has also taken other, more aggressive steps in response to this potential competition. Specifically, PGA Tour commissioner Jay Monahan threatened the game’s top players with suspension or even permanent expulsion from the Tour if they sign on with a proposed Premier Golf League. The Tour has long required players to limit their participation in non-Tour events; indeed, it has required the Tour’s express permission. But this latest action has taken things to the next level.

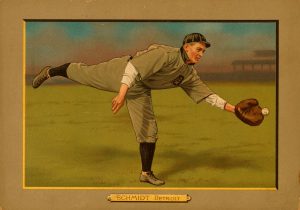

Our antitrust ears perk up any time a company tells those associated with it that they’ll be permanently banned if they do business with a competitor. And it reminds us of parallels in the sports world, particularly with professional baseball. Indeed, baseball has a long history with antitrust and labor issues stemming from would-be competitors, such as bare-knuckle tactics, player suspensions, and extensive litigation, including multiple cases to reach the Supreme Court. We have detailed that saga in several articles:

Part 1: Baseball and the Reserve Clause.

Part 2: The Owners Strike Back (And Strike Out).

Part 3: Baseball Reaches the Supreme Court.

Part 4: Baseball’s Antitrust Exemption.

Part 5: Touch ’em all, Curt Flood.

In short, for decades, professional baseball thwarted competition and suppressed salaries in the face of direct antitrust challenges by preventing player free agency and punishing (i.e., banning) players who opted to play for other leagues. Baseball, of course, at least for now, has an exemption from antitrust liability.

Moreover, not only is it easy to argue that the PGA Tour is a monopoly whose conduct might implicate Section 2 of the Sherman Antitrust Act, but the PGA Tour also has relationships with other entities that could implicate Section 1 of the Sherman Act, which bars anticompetitive agreements.

To begin, the PGA Tour recently launched a “Strategic Alliance” with the European Tour, meant to enhance “collaboration on global scheduling, prize money and playing privileges for both tours’ memberships.” There are many pro-competitive reasons for such as alliance, but there is also no question that the potential competition from the Premier Golf League was a significant factor.

Moreover, the PGA Tour has relationships with many key market actors, including sponsors, media companies, and other interests that could further complicate these issues. For example, what if sponsors withdraw from endorsement deals with a player because of his decision to join the PGL? Does this suggest an unlawful group boycott?

Relatedly, there are key golf events—such as golf’s four annual majors and the Ryder Cup—that are not explicitly run by the PGA Tour but are tied to performance in Tour events. Indeed, success on the PGA and European Tours is the primary way players qualify for major events. What if those events agree not to allow PGL players to qualify? Or even more blatantly, what if those events revoke invitations to players who have already qualified (for example, winners of the Masters, Open Championship, and PGA Championship receive lifetime invitations)?

The Antitrust Attorney Blog

The Antitrust Attorney Blog